Pressemitteilung -

2023 financial year: above-market growth at Gothaer

2023 financial year: above-market growth at Gothaer

- Double-digit growth in property and casualty insurance revenues at 10.7 percent

- Gothaer Kranken with 25 percent plus in new business

- Strong corporate client premium revenue growth of 9.5 percent

- Top marks among life insurers: Gothaer Leben receives an ‘AA’ rating in the Assekurata sustainability ranking

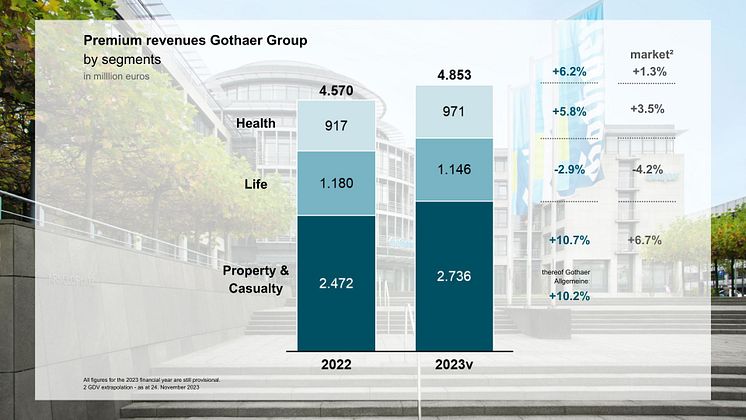

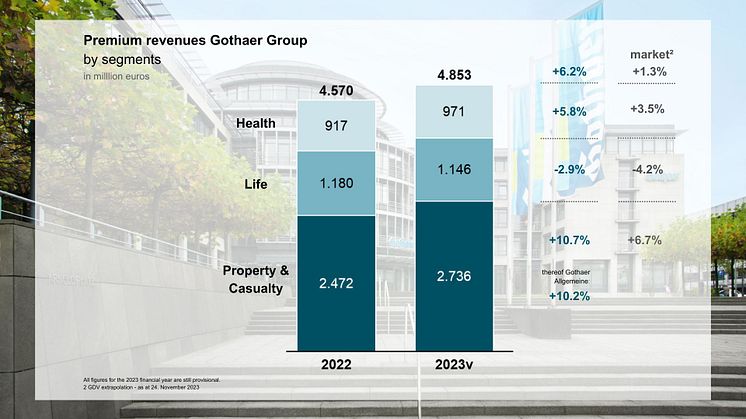

Cologne, 12 December 2023 – Gothaer Group CEO Oliver Schoeller and the other members of the executive management team present the preliminary figures for the current financial year at today’s virtual press conference. “We anticipate a 6.2 percent increase in premium revenues to 4.85 billion euros in 2023, which is clearly above the market growth rate. I am particularly pleased to see that growth in all segments is above market level and that we have managed to strengthen our position as a leading partner to SMEs with a 9.5 percent upswing in corporate client business,” said Schoeller.

This high level of growth is primarily being driven by the property & casualty and health insurance segments. The expected 10.7 respectively 5.8 percent growth in these segments is well above market (market growth rate: 6.7 percent and 3.5 percent respectively).[1] A problematic framework in the life insurance segment has had the strongest impact on single premium business. However, despite an expected 2.9 percent decline in life insurance premium revenues, Gothaer remains above market level in this segment (-4.2 percent).[2]

The Group’s equity base continued to gain in strength in an inflationary and recessionary framework during 2023 and it is projected to be in the region of € 1.58 billion at the end of the year (previous year: € 1.50 billion). Consolidated net income is expected to be between 70 and 80 million euros.

Another ‘A’ rating for Gothaer

Against this background, rating agency S&P Global Ratings (S&P) again reconfirmed an ‘A’ rating with a ‘stable’ outlook for the core Gothaer Group companies in mid-November 2023. As in the previous year, S&P highlighted the group’s high resilience and solid capital base. It additionally commended the strong competitive position, particularly in the small and medium-sized enterprise (SME) segment, the diversified product portfolio and the extensive network of sales channels. S&P also paid tribute to the Gothaer Group’s digitalisation activities in its report.[3]

9.5 percent growth in corporate insurance business

In the corporate client segment, Gothaer has further consolidated its position as a leading partner to SMEs. Gross premiums written are expected to increase by 9.5 percent to 1.62 billion euros. All three core companies are contributing to this growth. “In economically turbulent times it is particularly important for companies to have individual risk concepts and the support of a partner with both extensive expertise in their specific risks and a high level of underwriting competence,” summarised Schoeller.

Gothaer Allgemeine: double-digit premium revenue growth

Gross premiums written by Gothaer Allgemeine Versicherung AG are expected to reach 2.38 billion euros, which is 10.2 percent above the 2022 level and 3.6 percentage points above market. Despite claims inflation, the property insurer has remained resilient in another challenging year. Corporate client business is the strongest premium revenues growth driver and revenues in this segment are expected to increase by eleven percent. Growth of around nine percent is anticipated in the private client segment and over six percent in the mobility segment. “The strong figures in the corporate and private client business segments are excellent news and I am also particularly pleased about the excellent development in the mobility segment. I believe that our success is largely driven by our underwriting discipline and our consistent optimisation of processes and products, for which we have recently won several awards,” said Thomas Bischof, CEO of Gothaer Allgemeine Versicherung AG.

Gothaer Leben: strong growth in new business

Gross premiums written by Gothaer Lebensversicherung AG in 2023 are expected to decline in line with market developments (-3.2 percent) by 3.1 percent to 1.02 billion euros. This is primarily due to the interest rate-related decline in the attractiveness of single premium business. In contrast, corporate client business is developing positively. Around two percent growth is projected in this segment and new business (net premiums) expected to increase by 29 percent compared to the previous year. Gross profit is also developing against the prevailing trend in a challenging market, and it is expected to increase by 17.3 percent from 167 to 195 million euros. “These excellent new business figures are a reflection of the innovative strength of Gothaer Lebensversicherung. One of our innovative products that was very well received is our new occupational disability insurance. Our occupational pension schemes and collective biometrics have also contributed to the positive development of our corporate client business,” explained Michael Kurtenbach, CEO of Gothaer Lebensversicherung AG.

Gothaer Kranken: premium revenues approach the one billion euros mark

Gross premiums written by Gothaer Krankenversicherung AG are expected to rise by 5.8 percent to 971 million euros. As a result, Gothaer Krankenversicherung is expected to report growth of 2.3 percentage points above market.[4]Significant premium growth of 6.5 and 3.3 percent respectively is envisaged for both the supplementary and comprehensive insurance segments. For the first time, almost one million customers put their trust in Gothaer Krankenversicherung when it comes to health.

With an increase of 25 per cent, Gothaer Krankenversicherung is showing impressive new business growth in the areas of comprehensive health insurance, private supplementary insurance and company health insurance. Year-over-year growth in company health insurance business was particularly strong at 29 percent. “We are proud of the new record figures in our core business areas. Our strategy is working and the growth shows it. I am particularly pleased that our offerings have been so well received by the young adult target group.,” said Dr Sylvia Eichelberg, CEO of Gothaer Krankenversicherung AG.

Credible sustainability: Gold Label for sustainability reporting – ‘AA’ for Gothaer Lebensversicherung

Every year, Zielke Research Consult GmbH analyses the sustainability reports of German insurers with regard to the transparency of their corporate actions in the areas of environment, social and governance. As in the previous year, Gothaer took 3rd place and is one of 17 German insurers to receive the Gold Label. Zielke Research Consult positively highlighted the fact that Gothaer is one of 16 insurers to have its carbon emissions verified externally and one of five companies to have been transparent on its impact investments in its sustainability reporting.

In Assekurata's sustainability rating, Gothaer Leben was the top-scoring life insurer with an ‘AA’ (very good). In its rating process, the Assekurata Assekuranz rating agency not only assesses how an insurance company deals with sustainability-related risks for its own business activities (outside-in perspective), but also, and in particular, the extent to which it provides effective external sustainability impetus and thus has an impact on the environment and society (inside-out perspective). “I’m delighted that our comprehensive range of sustainability activities are rated so positively by third parties. These rankings and ratings provide us with valuable external feedback and create transparency for our customers and insurance agents. They also clearly communicate the high value placed on sustainability within the Gothaer Group to stakeholders,” explained Harald Epple, Chief Financial Officer and the board member with responsibility for sustainability issues.[5]

Merger with Barmenia

Schoeller confirmed that the due diligence audit in connection with the planned merger with Barmenia is proceeding according to plan. “Barmenia and Gothaer complement each other perfectly. The merger will enable us to significantly expand our competitive and market position and become one of the top 10 German insurers. Our aim is to become stronger and better together. The positive response to the announcement from the market and our insurance agents confirms that the merger is the right step to take.”

[1] GDV extrapolation – as at 24 November 2023.

[2] GDV extrapolation – as at 24 November 2023.

[3] Further information can be found in the press release dated 16 November 2023 at the following link https://presse.gothaer.de/pressreleases/s-und-p-bestaetigt-erneut-a-rating-fuer-die-gothaer-3286687

[4] GDV extrapolation – as at 24 November 2023.

[5] Further information can be found in the press release dated 7 December 2023 at the following link https://presse.gothaer.de/pressreleases/gothaer-lebensversicherung-ag-erhaelt-aa-im-assekurata-nachhaltigkeitsrating-3291263

Kategorien

Der Gothaer Konzern gehört mit rund 4 Millionen Mitgliedern und Beitragseinnahmen von 4,6 Milliarden Euro zu den großen deutschen Versicherungskonzernen und ist einer der größten Versicherungsvereine auf Gegenseitigkeit in Deutschland. Angeboten werden alle Versicherungssparten. Dabei setzt die Gothaer auf qualitativ hochwertige persönliche und digitale Beratung und Unterstützung ihrer Kund*innen.