Pressemitteilung -

2023 financial year: Gothaer outperforms the market in terms of growth

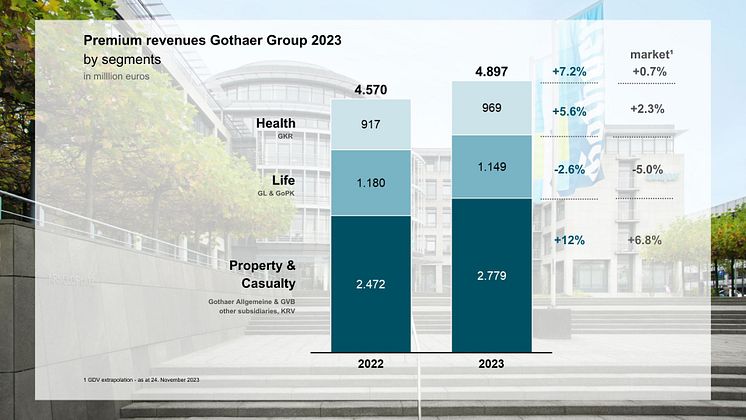

- 7.2 percent growth in premium revenues to € 4.9 billion

- Strong increase in premiums of 11 percent in the corporate client segment

- Double-digit growth of 12 percent in the property and accident insurance segment

- New business up 30 percent at Gothaer Leben

- Health insurance grows by 39 per cent in new business

- Next milestone reached in the Barmenia merger process

Cologne, April 19, 2024 – In a virtual press conference Gothaer Group CEO Oliver Schoeller and the other members of the executive management team communicated a very good result for the Gothaer Group at the close of the 2023 financial year despite the ongoing geopolitical and economic challenges. Another key press conference topic was the planned merger with Barmenia.

“Gothaer clearly outperformed the market with premium revenue growth of 7.2 percent to € 4.9 billion. This is all the more remarkable given the weak business climate, inflation, and persistently high interest rates, all of which posed major challenges for the insurance industry in the past year. I am particularly pleased that we have not only consolidated our position as a leading partner to SMEs but also remain on course for growth in the private client segment,” commented CEO Schoeller.

This strong development is primarily being driven by the property & casualty, and health insurance segments, which achieved significantly higher than market growth of 12 respectively 5.6 percent (market growth: 6.8 percent and 2.3 percent respectively).[1] The problematic framework in the life insurance segment had the strongest impact on single-premium business. However, despite a 2.6 percent decline in life insurance premium revenues, Gothaer remains clearly above market in this segment (5.0 percent decline).[2]

Despite inflation and recession worries, the Group's equity base was further strengthened in 2023: A value of € 1.57 billion was achieved at the end of the year (previous year: € 1.50 billion). Consolidated net income is in line with Group strategy at € 78 million. The excellent positioning and financial strength of Gothaer were again confirmed by the rating agency S&P Global Ratings, which issued a financial strength rating of ‘A’ with a ‘stable’ outlook for all three core companies.[3]

Corporate and private customer business on course for growth

All three Gothaer divisions achieved a strong sales performance and increased net production by at least 30 per cent each[4], Gothaer was not only able to further consolidate its position as a leading partner for SMEs, but also report a significant upswing in private client business. Gross premiums written in the corporate client segment increased by 11 percent to € 1.64 billion, with all three core companies contributing to that growth. In the private client segment premium income is € 2.55 billion, representing an increase of 2.9 percent.[5] The main drivers in this segment were the upturn in motor vehicle insurance business, the expanded range of supplementary health insurance products, and demand for product innovations in biometrics.

Gothaer Allgemeine: double-digit premium growth well above market

Gross premiums written by Gothaer Allgemeine Versicherung AG of € 2.42 billion were 12 percent above the 2021 level and 5.2 percentage points above market.[6] The strongest growth driver was corporate client business and premiums in this segment increased by 14 percent. Another record result was achieved in new business with net production totaling € 136 million, corresponding to year-over-year growth of around 44 percent. New business in the mobility segment developed particularly positively, almost quadrupling. The (gross) combined ratio improved around three percentage points to 95.3 percent. “Gothaer Allgemeine can look back on an extraordinarily successful financial year. Growth rates across all business segments show that we have a very diversified and robust position. This, together with our consistent underwriting discipline and our long-term pricing horizon, have been the mainstays that enabled us to overcome the effects of inflation and the financial burdens of natural events, and major losses,” said Thomas Bischof, CEO of Gothaer Allgemeine Versicherung AG.

Gothaer Leben: strong growth in new business

Gross premiums written by Gothaer Lebensversicherung AG in 2023 financial year declined by 2.9 percent to €1.02 billion. Despite the downturn, the life insurer remains ahead of the market, which recorded a fall of 3.9 percent.[7] The main reason for the fall in premium income is the further decline in single-premium business in 2023. Gothaer Lebensversicherung is aiming to reverse the trend in the current year and has therefore fundamentally enhanced its single-premium product Gothaer Index Protect (GIP). The new GIP offers customers improved return opportunities by increasing the index participation rate and a broader asset selection.

Gothaer Lebensversicherung AG reported premium growth of 0.5 and 5.0 percent respectively in corporate client business and biometrics. The turnaround in new business (net premiums) was impressive with a 30 percent upswing versus the previous year. The main driver was the new occupational disability insurance policy that was launched in 2023. Gross profit also increased by 12 percent to € 186 million in a challenging market environment. “With the new product landscape, we are well placed to return to growth on the premium side as well. The excellent new business figures and the growth in corporate client business and biometrics bolster our confidence that we are pursuing the right strategy,” explained Michael Kurtenbach, CEO of Gothaer Lebensversicherung AG.

Gothaer Kranken: strong in every segment

Gothaer Krankenversicherung AG presented strong growth in premium income and new business for 2023. Gross premiums written by Gothaer Krankenversicherung AG in 2023 rose by 5.6 percent to € 969 million, representing a development that is 3.3 percentage points higher than market growth for the health insurer.[8] Comprehensive insurance recorded a significant premium increase of 6.0 per cent. Supplementary insurance grew by 4.4 per cent. New business grew by 39 per cent. Comprehensive health insurance, supplementary private health insurance and company health insurance contributed to this growth.

"We are particularly proud of the strong growth in company health insurance, which increased by around 47 per cent," said Dr Sylvia Eichelberg, CEO of Gothaer Krankenversicherung. The number of insured persons also developed positively with an increase of 4.8 per cent. Including those insured in travel health insurance, Gothaer Krankenversicherung now has just under one million policyholders. "In the past year, we once again took a big step forward in terms of product and service innovations, delivering persuasive answers to the trend of greater health awareness. This is ultimately also reflected in our higher premium income and our very strong new business result,” said Eichelberg.

Merger with Barmenia to be completed by October 2024

Barmenia and Gothaer have reached the next important milestone ahead of their planned merger now that the management boards of both companies have signed a Business Combination Agreement (BCA). “Our management boards’ signatures represent a commitment to driving forward and facilitating the legal and commercial implementation of the merger in the best possible way,” said Schoeller, explaining the significance of the document.

The BCA sets out in writing the next steps towards the merger for the two companies, the specific necessary measures, and the prerequisites under which the merger will take place.

Commercial register entry application at the end of August

Another important milestone is the application for the entry of the new joint company in the Cologne commercial register, which is scheduled for the end of August. The merger is not official until this register entry is made. Both companies assume this will happen at the end of September or beginning of October 2024. The future holding company is to be called

Barmenia.Gothaer Finanzholding AG.

Locations and workforce to remain unchanged

The BCA further stipulates that the company headquarters in Wuppertal and Cologne remain in place and that, as of the date of the merger, all employees will receive a three-year guarantee of employment.

[1] GDV premium statistics as at March 20, 2024.

[2] GDV premium statistics as at March 20, 2024.

[3] Further information can be found in the press release dated 16 November 2023 at the following link https://presse.gothaer.de/pressreleases/s-und-p-bestaetigt-erneut-a-rating-fuer-die-gothaer-3286687

[4] Gothaer Allgemeine, Gothaer Leben incl. mutual insurance association, and Gothaer Allgemeine

[5] Gothaer Allgemeine, Gothaer Leben incl. pension trusts, and Gothaer Allgemeine

[6]GDV premium statistics as at March 20, 2024

[7]GDV premium statistics as at March 20, 2024 – Life insurance in the narrower sense, i.e. excluding pension trusts/pension funds

Pension trusts and pension funds

[8] GDV premium statistics as at March 20, 2024:

Kategorien

Der Gothaer Konzern gehört mit rund 4 Millionen Mitgliedern und Beitragseinnahmen von 4,6 Milliarden Euro zu den großen deutschen Versicherungskonzernen und ist einer der größten Versicherungsvereine auf Gegenseitigkeit in Deutschland. Angeboten werden alle Versicherungssparten. Dabei setzt die Gothaer auf qualitativ hochwertige persönliche und digitale Beratung und Unterstützung ihrer Kund*innen.