Pressemitteilung -

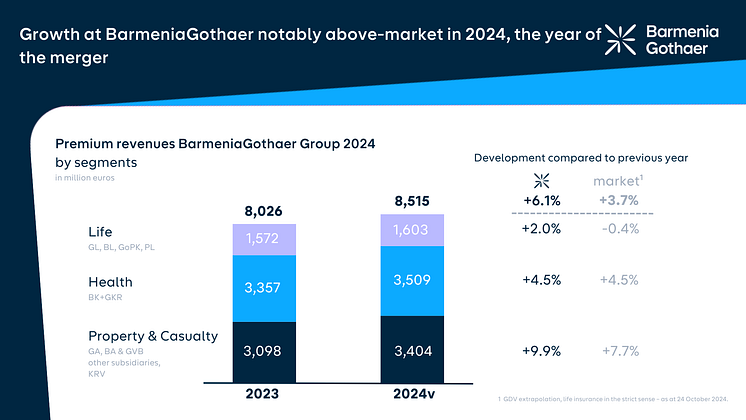

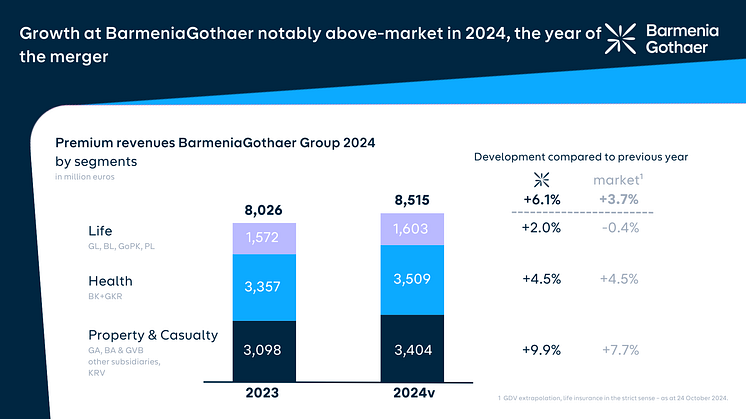

Growth at BarmeniaGothaer notably above-market in 2024, the year of the merger

- 6.1 percent growth in premium revenues to € 8.5 billion

- Double-digit growth in property and accident insurance premiums of around 10 percent

- Health insurance segment: BarmeniaGothaer is now one of the top 5 private health insurance providers with premium revenues of € 3.5 billion

- In the life segment, BarmeniaGothaer bucked the market trend with 2.0 percent growth

Cologne/Wuppertal, 6 December 2024 – The two Co-CEOs of BarmeniaGothaer, Dr. Andreas Eurich and Oliver Schoeller, were joined by the executive management team in Cologne today, in the year of the merger, to present the preliminary figures and strong growth in 2024 at a virtual press conference.

“2024 was very much dominated by our merger, which we completed in less than a year in September. The merger of the two life insurance companies and the BarmeniaGothaer brand launch were followed by further highlights in autumn, in what has been a very eventful year,” said Eurich. “Although this has been the year of our merger, we are able to report impressive growth,” emphasised Co-CEO Schoeller. “We are anticipating premium revenue growth of 6.1 percent to € 8.52 billion, which is significantly higher than the projected market growth of 3.7 percent. This is all the more remarkable given that we not only orchestrated a merger, but also faced an extremely challenging framework with a depressed economy, inflationary effects and the increased burden on the healthcare system.”

BarmeniaGothaer is expected to achieve growth at least on a par with the market across all business segments. The projected growth rate for the property and casualty insurance segment is particularly impressive at 9.9 percent (market growth: 7.7 percent).[1] In the health insurance segment, growth is expected to be in line with the market at 4.5 percent.[2]The life insurance segment is bucking the market trend (market shrinkage: 0.4 percent)[3]with 2.0 percent growth projected.

The Group equity base is expected to reach a solid value of around € 2 billion by the end of the year.

S&P confirmed its “A” rating and raised the outlook to “positive”

Rating agency S&P Global Ratings (S&P) raised the outlook for Gothaer Allgemeine Versicherung AG, Gothaer Krankenversicherung AG and Gothaer Lebensversicherung AG from “stable” to “positive” in June 2024 in light of the merger between Barmenia and Gothaer. In its report, S&P assumes that competitiveness will improve due to an even more diverse product portfolio, a more extensive network of sales channels and a broader customer base. S&P also recognised the very strong financial risk profile and emphasised the improved resilience across all insurance lines as a result of the diversified positioning. S&P’s upward revision of the outlook has opened up an opportunity to improve the current rating by a further increment to “A+” within the next 12 to 24 months.[4]

Property and casualty: double-digit, clearly above-market growth in premiums

The gross premiums written by Barmenia Allgemeine Versicherungs-AG and Gothaer Allgemeine Versicherung AG are expected be consolidated at € 3.01 billion, which is ten percent above the 2023 level. This means that the two property insurers will grow by 2.3 percentage points above the market.[5]The growth drivers are the private and corporate client business segments, where growth of twelve and eleven percent respectively is expected. Double-digit premium growth of ten percent is also anticipated for the mobility segment. “I’m very pleased that the property and accident insurance segment will cross the three billion euro premium revenue threshold for the first time and clearly outperform market growth. Not only have we managed to further consolidate our robust position as a leading partner to SMEs, our private client business has gained significant momentum as a result of the merger,” said Thomas Bischof, Board Member for Composite Insurance at BarmeniaGothaer.

Health: BarmeniaGothaer is one of the top 5 private health insurance providers

The consolidated gross premiums written by Barmenia Krankenversicherung AG and Gothaer Krankenversicherung AG are expected to develop in line with the market and increase by 4.5 percent to € 3.51 billion.[6] This puts BarmeniaGothaer among the top five private health insurance providers in the health insurance sector. The main growth driver is the supplementary insurance segment (including company health insurance), which is expected to see twelve percent growth. 2.3 percent growth is anticipated in the comprehensive insurance segment. The number of policyholders had risen to 3.2 million in October 2024 – an eight percent increase since October 2023. As a result of the merger, Barmenia-Gothaer is now also one of the top providers of company health insurance.

“In the year of the merger, we further improved our market position thanks to attractive products and services. Together, we were able to expand our portfolio of fully insured persons by over 6,000 - the strongest growth in insured persons for over 15 years. In supplementary insurance, including bKV, we were even able to gain more than 200,000 people,” explains Christian Ritz, Chief Health Officer at Barmenia-Gothaer

Life insurance: growth against the backdrop of a negative market trend

Gross premiums written by Gothaer Lebensversicherung AG in 2024 are expected to rise by 1.7 percent to € 1.33 billion. This is a strong performance for the life insurer, particularly considering that the market is expected to shrink by 0.4 percent.[7]The 4.9 percent growth single-premium business materialised, as envisioned, marking a turnaround point after the interest-rate-related challenges in previous years. Growth in regular premiums of 0.9 percent is expected.

New business (net premiums) is also developing extremely positively with 18 percent growth versus the previous year on the cards. The main reason for this is the introduction of a new occupational disability insurance product in mid-2023. “The fact that we are a life insurer achieving growth in the year of our merger, and even bucking the market trend, is a powerful success story that reflects our excellent positioning and innovative strength. High demand for the first joint BarmeniaGothaer product, the unit-linked pension insurance, is also testament to this,” commented Alina vom Bruck, Board Member for Life Insurance at BarmeniaGothaer.

Growing together

“BarmeniaGothaer will be focusing on growth in both senses of the word in 2025: growing the business and growing together into one single corporate entity,” explained Schoeller. The most important milestones in this process include the establishment of a shared culture, the combination of Gothaer and Barmenia’s formerly independent sales organisations, the creation of a joint product portfolio and the consolidation of our IT systems. “We will be relying on the combined strengths of Barmenia and Gothaer and intend to work together to achieve further improvements and exploit the full potential of the merger in the interests of our employees, insurance agents and customers,” added Eurich.

[1] GDV extrapolation – as at 24 October 2024.

[2] GDV extrapolation – as at 24 October 2024.

[3] GDV extrapolation, life insurance in the strict sense – as at 24 October 2024.

[4] Further information can be found in the press release dated 29 July 2024 at the following link: https://www.mynewsdesk.com/de/barmeniagothaer/pressreleases/s-und-p-bestaetigt-rating-ergebnisse-der-gothaer-und-stuft-ausblick-auf-positiv-hoch-3335345

[5] GDV extrapolation – as at: 24 October 2024

[6] GDV extrapolation – as at: 24 October 2024

[7] GDV extrapolation – as at: 24 October 2024

Die BarmeniaGothaer Gruppe gehört mit rund acht Millionen Kundinnen und Kunden, 7.500 Mitarbeitenden sowie Beitragseinnahmen von rund 8 Milliarden Euro zu den Top10 Versicherern in Deutschland und ist einer der größten Versicherungsvereine auf Gegenseitigkeit.

Angeboten werden alle Versicherungssparten für Privat- und Firmenkunden. Dabei setzt das Unternehmen auf qualitativ hochwertige persönliche und digitale Beratung sowie die Unterstützung seiner Kundinnen und Kunden auch über die eigentliche Versicherungsleistung hinaus. Als einer der führenden Partner für den Mittelstand bieten die BarmeniaGothaer Unternehmen eine umfassende Absicherung gegen alle relevanten Risiken. Neben vielfältigen Schutzkonzepten unterstützen sie ihre Firmenkunden auch bei aktuellen Herausforderungen wie der Mitarbeitendengewinnung und -bindung.

Privatkunden bietet die BarmeniaGothaer neben dem klassischen Versicherungsschutz und der Altersvorsorge auch digitale Services sowie vielschichtige Gesundheitsdienstleistungen. Als Versicherungsverein auf Gegenseitigkeit ist die BarmeniaGothaer nur ihren Mitgliedern – also ihren Kundinnen und Kunden verpflichtet – nicht etwa Aktionären. Durch diese Unabhängigkeit kann das Unternehmen langfristig und nachhaltig im Sinne seiner Mitglieder agieren.