Pressemitteilung -

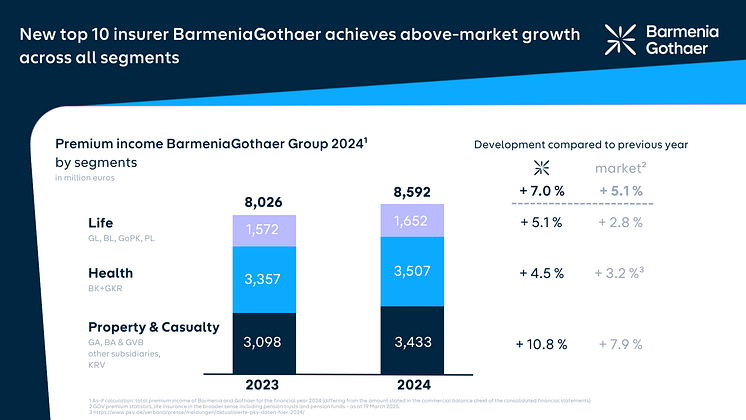

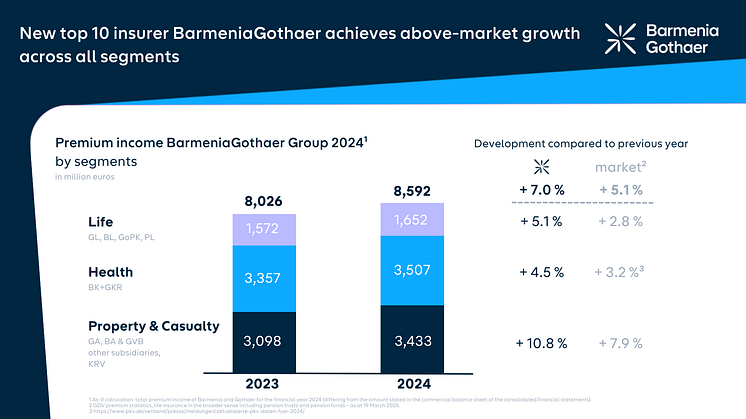

New top 10 insurer BarmeniaGothaer achieves above-market growth across all segments

Cologne/Wuppertal, 11 April 2024 – BarmeniaGothaer has closed the 2024 financial year with excellent growth figures. “The past twelve months have been eventful in many respects. Obviously, a key focus was the merger to form BarmeniaGothaer. At the same time, however, it was important to us to continue supporting our customers as a strong and dependable partner,” said Co-CEO Oliver Schoeller. “In a market environment that was challenging on many fronts, it is therefore all the more remarkable that we achieved above-market growth across all segments in the merger year,” added Co-CEO Dr. Andreas Eurich.

The BarmeniaGothaer Group is reporting total premium income of € 8.59[1], representing an increase of seven percent versus the previous year and growth of 1.9 percentage points above market level[2]. A particularly impressive growth performance of 10.8 percent (market growth: 7.9 percent)[3] was seen in the property and casualty segment.Above-market growth of 4.5 percent was also achieved in the segment of health insurance, accompanied by 5.1 percent growth in life insurance (market growth: 3.2 percent[4] and 2.8 percent[5]respectively).

The group equity base expanded to around two billion euros in 2024.

Property and casualty: double-digit, clearly above-market growth

Total gross premiums written by Barmenia Allgemeine Versicherungs-AG and Gothaer Allgemeine Versicherung AG rose by 11.1 percent to € 3.04 billion. This represents overall growth of 3.2 percentage points above market for the two property insurers[6]. Gothaer Allgemeine Versicherung AG was able to grow its corporate client business by 11.1 percent, whereas Barmenia Allgemeine Versicherungs-AG achieved 17.7 percent growth in private client business. New business (gross premium production) also developed favourably with an upturn of 22.7 percent at Barmenia Allgemeine Versicherungs-AG and 15 percent at Gothaer Allgemeine Versicherung AG. The (gross) combined ratio of Gothaer Allgemeine Versicherung AG improved by 1.9 percentage points to 93.4 percent. “I’m very pleased we are in a position to report double-digit growth in premiums across all key segments in the past financial year. This development further consolidates our strong market position in both corporate and private client business. It also confirms that pooling the complementary strengths of Barmenia and Gothaer was exactly the right thing to do,” said Thomas Bischof, CEO of the composite insurance segment at BarmeniaGothaer.

Health: around 3.2 million people trust in BarmeniaGothaer

Growth in total gross premiums written by Barmenia Krankenversicherung AG and Gothaer Krankenversicherung AG was 1.3 percent higher than market growth, increasing by 4.5 percent to € 3.51 billion[7]. This makes BarmeniaGothaer one of the top 5 providers of private health insurance (PKV). This positive development was primarily driven by the supplementary insurance segment, which saw premium growth of nine percent. The premium development in the future segment of company health insurance is particularly pleasing with an increase of around 37 per cent. Encouraging growth was also achieved in comprehensive insurance with a net increase of almost seven thousand people. The total number of insured persons rose by 211,000 compared to the previous year to around 3.2 million.

“For us, the marked expansion of our policyholder base is a clear indicator that people have confidence in our value proposition. Their trust is well placed, because the merger to form BarmeniaGothaer not only strengthens our community of insured persons, but also opens up new opportunities for us to further improve our performance by introducing more attractive products and services,” explained Christian Ritz, CEO of the health insurance segment at BarmeniaGothaer.

Life: improved market position

Gross premiums written by Gothaer Lebensversicherung AG in 2024 financial year increased by 5.5 percent to € 1.38 billion – which is 2.4 percentage points above market leve[8]. In the strategically important area of regular premiums 1.3 percent growth was achieved as compared to around 23 percent growth in single premiums. New business (gross premiums written) also developed very positively with 12.2 percent growth.

“We paved the way for this very good result by incorporating Barmenia Lebensversicherung a. G. into Gothaer Lebensversicherung AG. Important milestones were reached with the very successful launch of our first joint unit-linked pension insurance product and the establishment of our comprehensive joint target product portfolio for all sales channels. We intend to keep up this pace in the future in order to consistently improve our market position,” commented Alina vom Bruck, CEO of the life insurance segment at BarmeniaGothaer.

Outlook

BarmeniaGothaer expects to see further growth across all lines of insurance in 2025. “Nevertheless, the market environment will remain very challenging. Geopolitical tensions, a sustained weak business climate and, last but not least, climate change, will continue to have a massive impact on our industry. Our pension and health systems are also in urgent need of reform. It will therefore be all the more important for the new government to tackle the reform projects head-on and create the framework conditions for economic growth. This includes, in particular, a noticeable reduction in bureaucracy, the strengthening of European integration and a clear commitment to the sustainable transformation of our society," said Schoeller.

“In view of this very complex overall situation, it will be particularly crucial for our new corporate group to expedite the process of growing together while actively shaping market developments. The planned combination of the stand-alone sales organizations and the health insurers are key milestones in our roadmap, and we are steadily moving towards achieving them with a joint product portfolio. Advancing digitalization and the increasing use of AI means that investments in new technologies and digital solutions will also play an important role in our future success,” added Eurich.

[1] As-if calculation: total premium income of Barmenia and Gothaer for the financial year 2024 (differing from the amount stated in the commercial balance sheet of the consolidated financial statements)

[2] GDV premium statistics as at 19 March 2025

[3] GDV premium statistics as at 19 March 2025

[4]https://www.pkv.de/verband/presse/meldungen/aktualisierte-pkv-daten-fuer-2024/

[5] GDV premium statistics, life insurance in the broader sense including pension trusts and pension funds

– as at 19 March 2025.

[6] GDV premium statistics as at 19 March 2025

Themen

Kategorien

Die BarmeniaGothaer Gruppe gehört mit rund acht Millionen Kundinnen und Kunden, 7.500 Mitarbeitenden sowie Beitragseinnahmen von rund 8,5 Milliarden Euro zu den Top10 Versicherern in Deutschland und ist einer der größten Versicherungsvereine auf Gegenseitigkeit.

Angeboten werden alle Versicherungssparten für Privat- und Firmenkunden. Dabei setzt das Unternehmen auf qualitativ hochwertige persönliche und digitale Beratung sowie die Unterstützung seiner Kundinnen und Kunden auch über die eigentliche Versicherungsleistung hinaus. Als einer der führenden Partner für den Mittelstand bieten die BarmeniaGothaer Unternehmen eine umfassende Absicherung gegen alle relevanten Risiken. Neben vielfältigen Schutzkonzepten unterstützen sie ihre Firmenkunden auch bei aktuellen Herausforderungen wie der Mitarbeitendengewinnung und -bindung.

Privatkunden bietet die BarmeniaGothaer neben dem klassischen Versicherungsschutz und der Altersvorsorge auch digitale Services sowie vielschichtige Gesundheitsdienstleistungen. Als Versicherungsverein auf Gegenseitigkeit ist die BarmeniaGothaer nur ihren Mitgliedern – also ihren Kundinnen und Kunden verpflichtet – nicht etwa Aktionären. Durch diese Unabhängigkeit kann das Unternehmen langfristig und nachhaltig im Sinne seiner Mitglieder agieren.